10 Easy Facts About Hiring Accountants Explained

Table of ContentsGetting The Hiring Accountants To WorkThe Ultimate Guide To Hiring AccountantsAn Unbiased View of Hiring AccountantsGetting My Hiring Accountants To Work4 Simple Techniques For Hiring Accountants

Is it time to hire an accountant? If you're an SMB, the appropriate accounting professional can be your buddy. At costs, we have actually seen firsthand the transformative power that business owners and accounting professionals can open together. From simplifying your tax returns to evaluating financial resources for boosted earnings, an accountant can make a large difference for your company.An accountant, such as a state-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT), has specialized expertise in financial monitoring and tax conformity. They keep up to day with ever-changing laws and best practices, guaranteeing that your company remains in compliance with lawful and regulative demands. Their expertise allows them to browse complex monetary matters and give precise trusted suggestions customized to your specific business needs.

For those who don't currently have an accountant, it may be hard to understand when to reach out to one. Every business is various, yet if you are dealing with difficulties in the following locations, now may be the appropriate time to bring an accountant on board: You do not have to create a service plan alone.

Hiring Accountants for Dummies

The stakes are high, and an expert accounting professional can assist you obtain tax obligation recommendations and be prepared. Hiring Accountants. We suggest chatting to an accounting professional or various other finance professional concerning a variety of tax-related goals, including: Tax obligation planning techniques. Collecting financial info for exact tax declaring. Finishing tax return. Making sure conformity with tax laws and guidelines.

By working with an accountant, services can strengthen their financing applications by providing more exact financial info and making a far better situation for financial viability. Accounting professionals can additionally assist with tasks such as preparing financial papers, evaluating monetary data to evaluate credit reliability, and developing a detailed, well-structured funding proposition. When points change in your business, you wish to make certain you have a solid deal with on your finances.

Are over here you all set to market your service? Accountants can help you establish your service's value to aid you protect a fair deal.

The Facts About Hiring Accountants Revealed

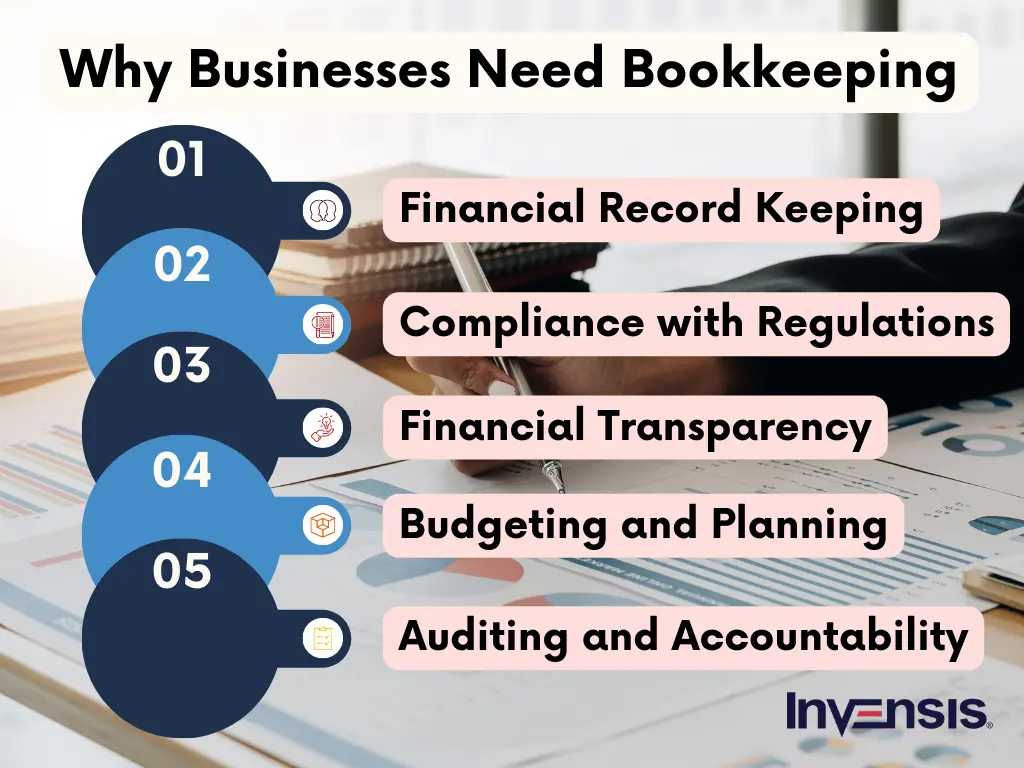

People are not required by legislation to maintain financial publications and documents (companies are), but refraining this can be a costly error from a financial and tax perspective. Your savings account and charge card statements may be incorrect and you may not discover this till it's too late to make modifications.

Whether you need an accounting professional will probably depend upon a few factors, including how complicated your taxes are to file and the number of accounts you need to manage. This is an individual that has training (and blog likely an university level) in bookkeeping and can deal with bookkeeping tasks. The hourly price, which again depends on area, job summary, and experience, for an independent accounting professional is about $35 per hour on typical but can be substantially more, align to $125 per hour.

Some Of Hiring Accountants

While a CPA can offer accounting solutions, this expert may be as well expensive for the task. Hourly fees for CPAs can run around $38 per hour to begin and enhance from there. (A lot of CPAs don't manage accounting services directly however utilize a staff member in their company (e.g., a bookkeeper) for this job.) For the tasks described at the beginning, an individual accountant is what you'll require.

It syncs with your bank account to streamline your individual financial resources. You can function with a bookkeeper to aid you get begun with your personal accountancy.

The bookkeeper can also examine your work regularly (e.g., quarterly) to see to it you're videotaping your revenue and expenditures properly and reconciling your financial institution statement properly. Nonetheless, you choose to handle your individual audit, make certain to divide this from audit for any type of service you own. find out Construct the cost of this accounting into your home spending plan.

Facts About Hiring Accountants Revealed

As tax season strategies, people and companies are faced with the seasonal question: Should I tackle my taxes alone or employ a specialist accounting professional? While the appeal of conserving cash by doing it on your own may be appealing, there are compelling reasons to take into consideration the know-how of a certified accounting professional. Right here are the top reasons why employing an accounting professional may be a smart financial investment contrasted to navigating the complicated globe of taxes by yourself.

Tax obligations are complicated and ever-changing, and a seasoned accountant remains abreast of these modifications. Employing an accountant frees up your time, allowing you to focus on your personal or business activities.